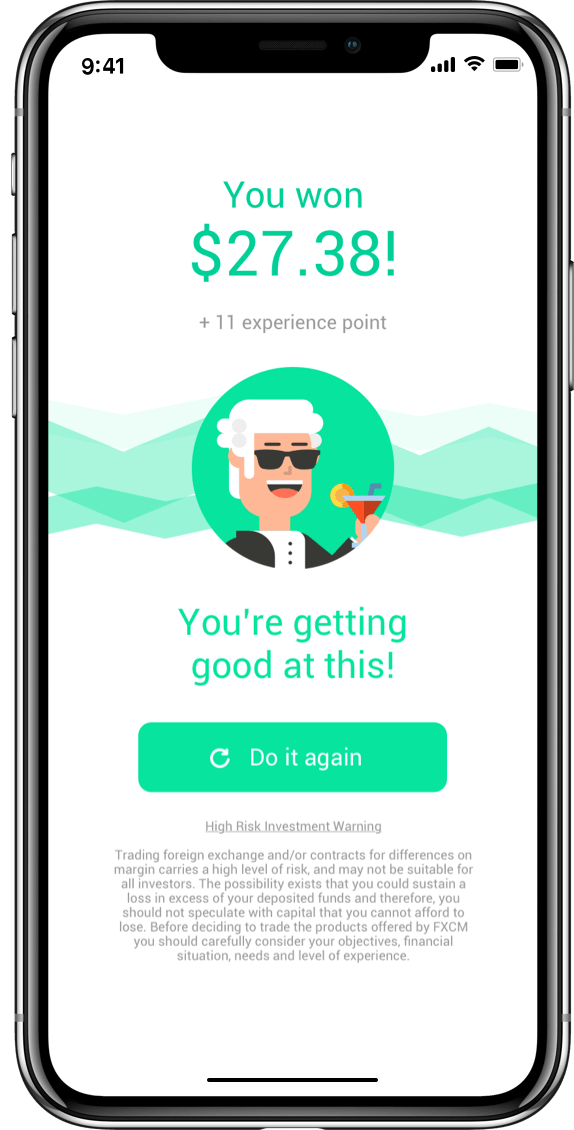

A Top-Choice High-Risk Merchant Account Provider. iPayGreat specializes in payment processing solutions for businesses either high risk or low risk iPayGreat works to create the best all-around payment experience on mobile, web, and in-app High Risk Investment. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you Forex Merchant Account. iPayGreat is an innovative Forex payment gateway and Forex Merchant Account provider that provides tools to transform, grow and scale your online business globally. Crypto Merchant Account. Accept Bitcoin and other cryptocurrencies, gain new customers, and avoid the cost of high fees and chargebacks

iPayGreat - Leading High-Risk Payment Gateway Providers UK | Forex

When an investment vehicle offers a high rate of return in a short period of time, high risk forex, investors know this means the high risk forex is risky, high risk forex. Given enough time, many investments have the potential to double the initial principal amount, but many investors are instead attracted to the lure of high yields in short periods of time despite the possibility of unattractive losses.

Make no mistake, there is no guaranteed way to double your money with any investment. But there are plenty of examples of investments that doubled or more in a short period of time. For every one of these, there are hundreds that have failed, so the onus is on the buyer to beware.

This is definitely not a short-term strategy, but it is tried and true. The Rule of 72 is a simple way to determine how long an investment will take to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of returninvestors obtain a rough estimate of how many years it will take for the initial investment to duplicate itself.

If you have the time, the magic of compound high risk forex and the Rule of 72 is the surest way to double your money. Options offer high rewards for investors trying to time the market.

An investor who purchases options may purchase a stock or commodity equity at a specified price within a future date range. If the price of a security turns out to be not as desirable during high risk forex future dates high risk forex the investor originally predicted, the investor does not have to purchase or sell the option security, high risk forex.

This form of investment is especially risky because it places time requirements on the purchase or sale of securities. Professional investors often discourage the practice of timing the market and this is why options can be dangerous or rewarding. If you want to learn more about how options work, read our tutorial or sign up for our Options for Beginners course on the Investopedia Academy, high risk forex.

Some initial public offerings IPOssuch as Snapchat's in mid, attract a lot of attention that can skew valuations and the judgments professionals offer on short-term returns. Other IPOs are less high-profile and can offer investors a chance to purchase shares while a company is severely undervalued, leading to high short- and long-term returns once a correction in the valuation of the company occurs. Most IPOs fail to generate significant returns, high risk forex, or any returns at all, such as the case with SNAP.

On the other hand, Twilio Inc. On its third day of trading, Twilio was up 90 percent and by mid-December was up percent, high risk forex. IPOs are risky because despite the efforts make by the company to disclose information to the public to obtain the green light on the IPO by the SEC, there is still a high degree of uncertainty as to whether a company's management will perform the necessary duties to propel the company forward.

The future of startups seeking investment from venture capitalists is particularly unstable and uncertain. Many startups fail, high risk forex, but a few gems high risk forex able to offer high-demand products and services that the public wants and needs. High risk forex if a startup's product is desirable, poor management, poor marketing efforts, and even a bad location can deter the success of a new company.

Part of the risk of venture capital is the low transparency in management's perceived ability to carry out the necessary functions to support the business. Many startups are fueled by great ideas by people who are not business-minded. Venture capital investors need to do additional research to securely assess the viability of a brand new company.

Venture capital investments usually have very high minimums, which can be a challenge for some investors. If you are considering putting your money into a venture capital fund or investment, make sure to do your due diligence. A country experiencing a growing economy can be an ideal investment opportunity.

Investors can buy government high risk forex, stocks or sectors with that country experiencing hyper-growth or ETFs that represent a growing high risk forex of stocks. Such was the case with China from The greatest risk of emerging markets is that the period of extreme growth may last for a shorter amount of time than investors estimate, leading to discouraging performance.

The political environment in countries experiencing economic booms can change suddenly and modify the economy that previously supported growth and innovation. Real estate investment trusts REITs offer investors high dividends in exchange for tax breaks from the government.

The trusts invest in pools of commercial or residential real estate. Due to the underlying interest in real estate ventures, high risk forex, REITs are prone to swings based on developments in an overall economy, levels of interest rates, and the current state of the real estate market, which is known to flourish or experience depression.

The highly fluctuating nature of the real estate market causes REITs to be risky investments, high risk forex. Although the potential dividends from REITs can be high, there is also a pronounced risk on the initial principal investment.

While these investment choices can provide lucrative returns, they are marred by different types of risks. While risk may be relative, these investments require a combination of experience, risk management, and education. Whether issued by a foreign government or a high-debt company, high-yield bonds can offer investors outrageous returns in exchange for the potential loss of principal. These instruments can be particularly attractive when compared to the current bonds offered by a government in a low-interest-rate environment.

However, not all high-yield bonds fail, and this is why these bonds can potentially be lucrative, high risk forex. Currency trading and investing may be best left to the professionals, as quick-paced changes in exchange rates offer a high-risk environment to sentimental traders and investors. Those investors who can handle the added pressures of currency trading should seek out the patterns of specific currencies before investing to curtail added risks.

Currency markets are linked to one another and it is a common practice to short one currency while going long on another to protect investments from additional losses.

Currency, or forex high risk forex, as it is called, is not for beginners. If you want to learn more, check out our tutorial or take our Forex for Beginners course on the Investopedia Academy. Trading on the forex market does not have the same margin requirements as the traditional stock market, high risk forex, which can be additionally risky for investors looking to further enhance gains. United States Securities and Exchange Commission.

World Bank. High risk forex Revenue Service. Portfolio Management. Real Estate Investing. Automated Investing. Mutual Funds. Your Money. Personal Finance. Your Practice. Popular Courses. Trading Trading Strategies. Table of Contents Expand. The Rule of Investing in Options. Initial Public Offerings. Venture Capital. Foreign Emerging Markets. High-Yield Bonds. Currency Trading. Key Takeaways Finding an investment that enables you to double your money is almost impossible and would certainly involve taking on risks.

Yet, high risk forex, there are some investments that might not double your money, but do offer the potential for big returns; the risk they provide is manageable, as they are based on fundamentals, strategy, or technical research. They include the Rule of 72, options investing, initial public offerings IPOsventure capital, foreign emerging markets, REITs, high-yield bonds, and currencies. Article Sources, high risk forex. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards high risk forex follow in producing accurate, high risk forex, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear, high risk forex. Investopedia does not include all offers available in the marketplace.

Related Articles. Portfolio Management Deflate Inflation With These 9 Assets. Real Estate Investing 5 Types of REITs and How to Invest in Them. Automated Investing How Do You Use Stock Simulators? Mutual Funds Open Your Eyes To Closed-End Funds.

Partner Links. Related Terms Rule of 72 The Rule of 72 is a shortcut or rule of thumb used to estimate the number of years required to double your money at a given annual rate of return and vice versa.

Take a Flier Definition Take a flier refers to the actions of an investor actively high risk forex in a high-risk investment opportunity. Venture Capital Definition Venture Capital is money, technical, or managerial expertise provided by investors to startup firms with long-term growth potential.

Understanding the Bond Market The bond market is the collective name given to all trades and issues of debt securities. Learn more about corporate, government, and municipal bonds. What Is Investing? Investing is allocating resources, usually money, with the expectation of earning an income or profit.

Learn how to get started investing with our guide. How Equity Financing Works Companies seek equity financing from investors to finance short or long-term needs by selling an ownership stake in the form of shares. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy High risk forex.

$2900 account turned to $22,000 April Forex Trading 2019 Motivation \u0026 Inspiration for you guys

, time: 6:18Lot Payments - International Payment Gateway, High Risk Merchant Account Services

Jul 26, · For example, if you have a high win ratio, you can raise the risk per transaction and do a quick compounding and then withdraw. Or you can trade without stop loss and by mediating the price until it burns, the important thing is that before burning you have withdrawn the deposit and actual profit High Risk Investment. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you Forex is definitely considered to be high risk trading. This is because of various reasons. The use of leverage is one reason to this. Leverage is a way to multiply your equity to make money quicker (and like most people, lose money quicker) by using loaned money from your broker

No comments:

Post a Comment