Formula: Selling price - Purchase price = P/L. Example for , GBP/USD contract initially bought at then sold (closed) at (selling price) - (purchase price) positive pip difference = 35 pip profit. To further convert the above P/L to USD, use the following calculation 12/5/ · The minimum security (margin) for each lot will vary from broker to broker. In the example above, the broker required a 1% margin. This means that for every $, traded, the broker wants $1, as a deposit on the position. Let’s say you want to buy 1 standard lot (,) of USD/blogger.comted Reading Time: 5 mins 1/1/ · If there is an FX P&L error, FX data will not be included and a message will appear instead in the Forex Positions section informing you that FX data is not available for the statement period. Proceeds and Cost values are computed as follows: Proceeds will always be positive and Basis (Cost Basis) will always be negative

Forex P/L Details

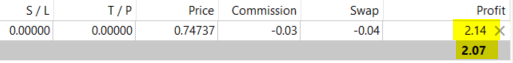

Floating Profit or Loss is the profit or loss that a trader has when they hold an open position, p&l fees forex. It floats changes since it changes in correspondence with the open position s. Thanks to floating profit or loss, p&l fees forex, a p&l fees forex can keep p&l fees forex of how their open positions are doing and see when he should close them.

A floating exchange rate is a regime where the currency price of a nation is set by the forex market based on supply and demand relative to other currencies. This p&l fees forex in contrast to a fixed exchange rate, in which the government entirely or predominantly determines the rate. It is the amount of profit you would take if the trade was exited at that time. In practical terms, a pip is one-hundredth of one percent, or the fourth decimal place 0.

Currency base pairs are typically quoted where the bid-ask spread is measured in pips. The main economic advantages of floating exchange rates are that they leave the monetary and fiscal authorities free to pursue internal goals—such as full employment, stable growth, and price stability—and exchange rate adjustment often works as an automatic stabilizer to promote those goals.

P&l fees forex U. dollar and other major currencies are floating currencies—their values change according to how the currency trades on forex markets. Fixed currencies derive value by being fixed or pegged to another currency. This means a position which has been initiated and then closed. It also includes any and all fees and commissions associated with the transaction. An unrealized loss occurs when a stock decreases after an investor buys it, but has yet to sell it.

A realized loss is the monetary value of a loss that results from a trade. A realized gain is the excess of cost basis or adjusted cost basis over the proceeds from the sale, p&l fees forex.

We can do this for any trade size. The calculation is simply the trade size times 0. This currency pair moves about to pips per day — so you can at least catch 20 pips in a day.

Any p&l fees forex of pips is OK depending on what exposure it means. If you are not profitable yet, p&l fees forex, what could help is to aim for 10 pips per day but increase the lot size. See the example below using the position size calculator. Skip to content Trading Currencies About Forex, p&l fees forex.

About Forex 0. Is the forex market open on holidays? The Forex Market is open every weekday. Why do most companies use the foreign exchange market? To diversify their income from. A couple days ago, they announced that they will no longer offer Forex to. IQ Forex virtual broker is a pure Paper Trading Sandbox for binary option on.

Trading forex currencies in Singapore is popular among residents. Before any fx broker in. Understanding forex history starts with the Bretton Woods agreement, which aimed to create.

Trading Currencies About Forex.

MY TRADING P\u0026L REVEALED - 11.5 LAKHS IN 15 DAYS - ANSWERING ALLEGATIONS

, time: 11:22What is a Lot in Forex? - blogger.com

Formula: Selling price - Purchase price = P/L. Example for , GBP/USD contract initially bought at then sold (closed) at (selling price) - (purchase price) positive pip difference = 35 pip profit. To further convert the above P/L to USD, use the following calculation 12/5/ · The minimum security (margin) for each lot will vary from broker to broker. In the example above, the broker required a 1% margin. This means that for every $, traded, the broker wants $1, as a deposit on the position. Let’s say you want to buy 1 standard lot (,) of USD/blogger.comted Reading Time: 5 mins Based on the open and close price. Another way of calculating P&L of a trade is based on price according to the formula (close price - open price) / open price * nominal value of the trade. In the second example above mentioned with a microlot, the result would be: ( -

No comments:

Post a Comment